You might assume that your standing as “wealthy” or “poor” relies in your checking account. However in response to one New York man, these numbers imply nothing.

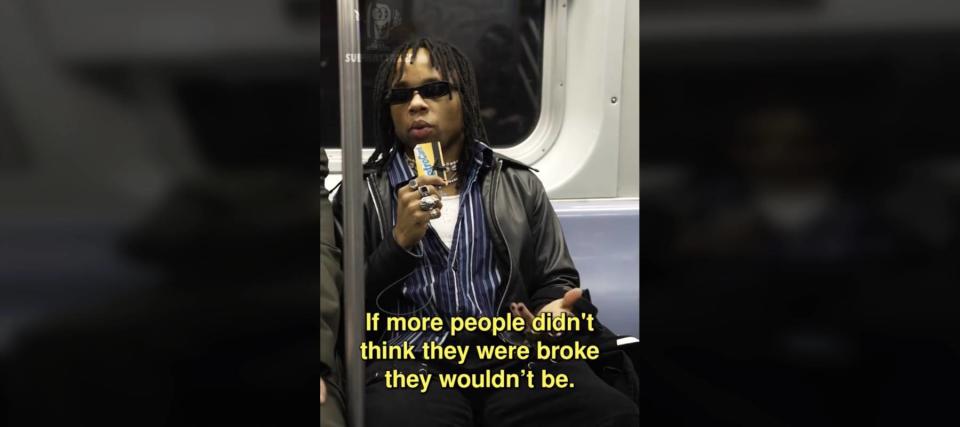

Huge Apple musician Jean-Luc explains how he got here to this conclusion on a current episode of Subway Takes, a one-minute interview present on TikTok that takes place on a subway prepare in New York Metropolis. Host Kareem Rahma kicks off every episode by asking his company the identical query: What’s your take?

Do not miss

“Being broke is a mindset,” Jean-Luc says. “If extra folks didn’t assume that they had been broke, they wouldn’t be.”

Rahma agrees together with his take. However quickly after, Jean-Luc admits that he has $100,000 in bank card debt (plus curiosity), but plans to go to the Gucci retailer and eat on the iconic, but dear, Balthazar restaurant later that day. He’s additionally booked a trip to the Caribbean island of Saint Barthelemy.

So is Jean-Luc on to one thing — or is he delusional?

Wealthy frame of mind

You might be stunned to be taught that non-public finance professional and radio host Dave Ramsey equally believes there’s a distinction between being poor and residing prefer it.

“Poor is a frame of mind,” Ramsey mentioned in a 2018 YouTube video. “I’ve been broke, however I’ve by no means been poor.”

Ramsey believes {that a} poor particular person can have a wealthy mindset, and a wealthy particular person can have a poor mindset. Consider a belief fund child who spends all their cash or a lottery winner who loses all of their winnings.

Learn extra: Wealthy younger People have misplaced confidence within the inventory market — and are betting on these 3 belongings as an alternative. Get in now for sturdy long-term tailwinds

Story continues

However this is the distinction

The place the 2 males differ is that Jean-Luc desires to really feel wealthy, whereas Ramsey goals to be wealthy.

Jean-Luc believes that “you don’t even must be wealthy to behave prefer it.” He lives this mantra by shopping for costly garments and happening sunny holidays.

However Ramsey believes a wealthy mindset is one which propels somebody to generate wealth. As a substitute of racking up $100,000 in debt, he would make investments the cash over the long-term so he may purchase garments and go on holidays freed from penalties.

Ramsey seemingly would accuse Jean-Luc of participating in “poor folks stuff” by spending recklessly, one thing he vehemently disapproves of.

Learn how to act wealthy

Ramsey explains what “wealthy folks habits” appear to be by utilizing lotteries for example. He quotes a Bloomberg article citing a Bankrate examine that claims the lowest-income households in America on the time spent $412 per 12 months on lottery tickets, practically 4 occasions greater than the highest-income households. For some, successful a jackpot might look like an avenue out of poverty.

However Ramsey thinks that is the other of considering wealthy.

“When you put [money] within the lottery you already know what you should have at retirement? Nothing,” Ramsey mentioned.

Ramsey explains that someone with a wealthy particular person’s mindset would take the $412 a 12 months usually spent on lottery tickets and put it right into a growth-stock mutual fund as an alternative. Doing so over numerous many years may lead to a retirement nest egg price a whole bunch of 1000’s.

Ramsey admits he wasn’t at all times this manner. As a younger man, his enterprise missteps induced him to file for chapter as he owed hundreds of thousands of {dollars} in short-term debt. He carries the teachings he’s discovered from his experiences.

“If I continued to make these silly selections, I’d nonetheless be broke,” he mentioned.

What to learn subsequent

This text gives info solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any variety.