UK inflation dropped less than forecast to 2.3 per cent in April, in a blow to hopes that the Bank of England would be ready to cut interest rates as soon as next month.

The annual rise in the consumer price index was larger than the 2.1 per cent forecast by the BoE and economists polled by Reuters, while services inflation — which the BoE is watching closely as it gauges when to lower the cost of borrowing — also sharply overshot expectations.

The Office for National Statistics figures put headline inflation close to the BoE’s 2 per cent target for the first time since mid-2021, easing pressure on households and prompting Prime Minister Rishi Sunak to hail it as a “major moment for the economy”.

But economists said signs of continued, widespread pricing pressures in the ONS report meant the chances of a rate reduction at the June 20 meeting of the BoE Monetary Policy Committee had significantly diminished.

“Today’s release was a bit of a blow for the BoE and the prime minister,” said Paul Dales, economist at research company Capital Economics. Inflation was proving “more stubborn than expected, which makes a June rate cut unlikely”, he added.

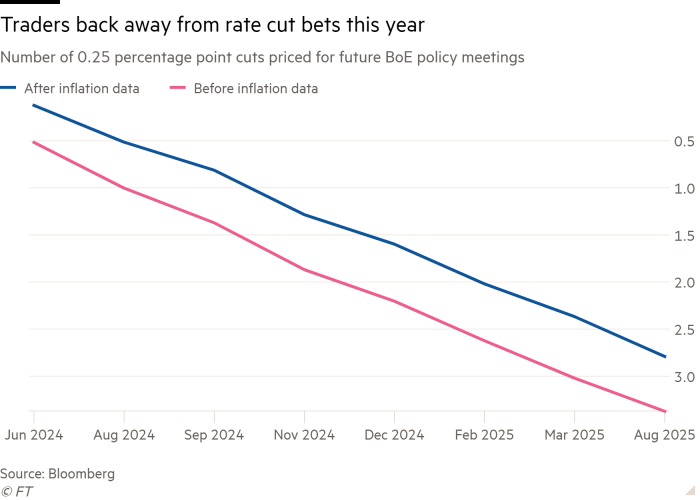

The data prompted markets to back away from bets that the BoE would lower interest rates, which stand at a 16-year high of 5.25 per cent, this summer.

Traders had been evenly split on the chance of a rate cut by June ahead of the announcement but now place the likelihood of a reduction by August at less than 50 per cent. Two-year gilt yields rose 0.12 percentage points to 4.43 per cent, the biggest daily move since early April.

The pound strengthened 0.1 per cent against the dollar to $1.272 after the ONS release.

Sunak and chancellor Jeremy Hunt hope that the return to what they call “normal” levels of inflation will allow them to reset the economic debate in the UK ahead of an election this year.

Hunt told the BBC the economy was experiencing “a soft landing” and that Britain should be confident about the future, but he admitted that many voters had been left “bruised and battered” by recent economic shocks.

“Prices are a lot higher than they were a year ago so it will take some time for that pressure to ease on family budgets,” he said. The chancellor confirmed that for many voters at the moment “life is tough”.

A reduction in official interest rates would be hailed by the Conservatives as a major landmark in their efforts to turn around the economy. But Yael Selfin, chief economist at advisory firm KPMG UK, said the data might still not be enough to convince “more cautious MPC members to commit to a rate cut in June, especially while wage growth remains elevated and economic growth momentum is strong”.

The BoE’s policymakers had forecast a steep fall in inflation owing to a reduction in the regulatory cap on household energy bills last month. Lower utility bills, coupled with easing food inflation, helped pull the headline rate lower.

However, MPC members want to see wider evidence that price pressures are receding before cutting rates.

Data on the level of services prices will be a key factor because the BoE sees it as an important gauge of the strength of domestic pricing pressures. Problems with the quality of ONS labour force numbers, coupled with volatility in wage data, are further focusing BoE attention on readings of services price inflation.

The ONS reported that year-on-year services price growth was 5.9 per cent in April, only marginally below the 6 per cent reading for March.

The reading was well above the 5.5 per cent rate of services price inflation expected by economists and the BoE in the latest round of forecasts.

“Services CPI inflation is the best gauge of underlying inflation and this remains uncomfortably high,” said Tomasz Wieladek, economist at investment company T Rowe Price. “The data today clearly show that markets were too optimistic about a June cut and remain too optimistic about BoE cuts this year.”

Core inflation, which strips out more volatile food and fuel prices, also fell much less sharply than anticipated. It came in at 3.9 per cent, down from 4.2 per cent the previous month but above a forecast of 3.6 per cent by economists polled by Reuters.

Rachel Reeves, shadow chancellor, said voters were still feeling the pinch. “After 14 years of Conservative chaos families are worse off,” she said.

In a further disappointment for the government, separate official data on Wednesday showed the UK public finances were in worse shape than expected in April.

Public sector borrowing was £20.5bn last month, more than the £19.3bn forecast by the Office for Budget Responsibility, the independent fiscal watchdog.