Nature/iStock via Getty Images

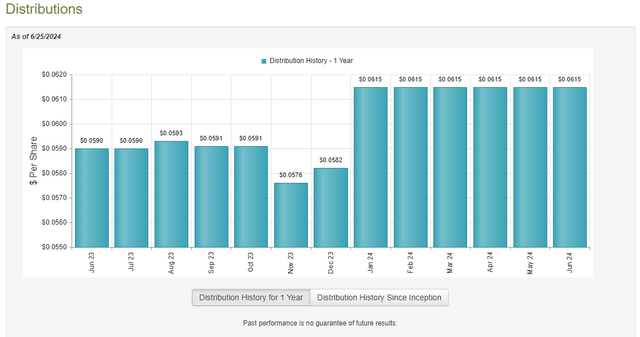

The Franklin Limited Duration Income Trust (NYSE:FTF) is a closed-end fund, or CEF, that income-seeking investors can purchase as a method of achieving their goals. As is the case with many closed-end funds investing in short-duration credit securities, the Franklin Limited Duration Income Trust boasts a very attractive yield that is certain to appeal to most individuals who are seeking to earn a high level of income. As of the time of writing, shares of the fund yield 11.59%, which is primarily due to a large increase in the distribution that occurred back in January:

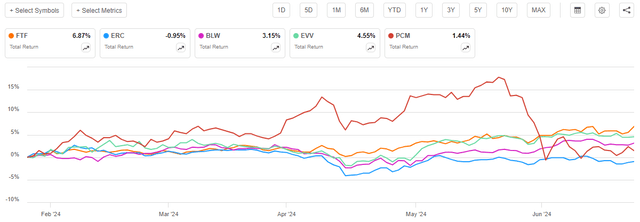

The 11.59% yield of the Franklin Limited Duration Income Trust compares pretty well to its peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Franklin Limited Duration Income Trust |

Fixed Income-Taxable-Limited Duration |

11.59% |

|

Allspring Multi-Sector Income Fund (ERC) |

Fixed Income-Taxable-Limited Duration |

8.82% |

|

BlackRock Limited Duration Income Trust (BLW) |

Fixed Income-Taxable-Limited Duration |

9.36% |

|

Eaton Vance Limited Duration Income Fund (EVV) |

Fixed Income-Taxable-Limited Duration |

9.71% |

|

PCM Fund (PCM) |

Fixed Income-Taxable-Limited Duration |

12.40% |

As we can clearly see, the only fund whose yield exceeds that of the Franklin Limited Duration Income Trust is the PCM Fund. That is not likely to be especially surprising for most regular readers. After all, as we have seen in various previous articles, funds from Franklin Templeton and PIMCO tend to have higher yields than funds from other managers. In particular, Eaton Vance and BlackRock both frequently market closed-end funds with lower yields than can be obtained elsewhere. However, the fact that the Franklin Limited Duration Income Trust has a substantially higher yield than most of its peers means that we should pay special attention to its finances, as there is a chance that it might be distributing more than its assets actually earn.

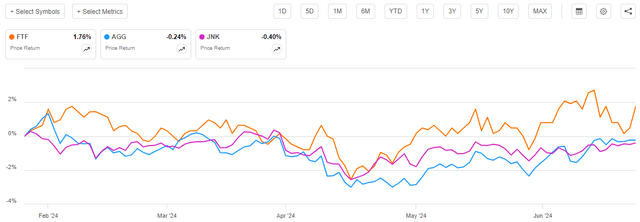

As regular readers can likely remember, we previously discussed the Franklin Limited Duration Income Trust back in late January 2024. The domestic bond market in general has been rather weak since that time, as both investment-grade (AGG) and junk bond (JNK) indices have declined:

This is not exactly too surprising, as the market’s expectations of the direction of interest rates in 2024 were far too dovish earlier this year. All that we are seeing here is the market repricing bonds to a more appropriate level for a “higher for longer” environment. Limited Duration credit securities, such as the ones that the Franklin Limited Duration Income Trust invests in, should not be as affected by this. After all, duration is a measure of an asset’s price sensitivity to interest rate movements.

As such, we can expect the Franklin Limited Duration Income Trust to have outperformed the two indices, but still have not delivered anything truly amazing. That is indeed the case, as shares of the fund have risen by 1.76% since the previous article on it was published:

When we consider the performance that common stocks or several other closed-end fixed-income funds have delivered over the period, it is unlikely that this fund’s performance will earn it any accolades.

However, as I pointed out in various previous articles:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

The yield of the Franklin Limited Duration Income Trust is substantially higher than the yield of either of the two major domestic bond indices:

|

Asset |

Current Yield |

|

Franklin Limited Duration Income Trust |

11.59% |

|

iShares Core U.S. Aggregate Bond ETF |

4.63%* |

|

SPDR Bloomberg High Yield Bond ETF |

7.49%* |

* 30-day SEC Yield as of the time of writing.

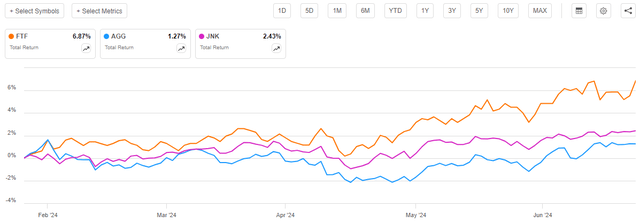

When we combine this with the fact that the fund’s share price outperformed the indices over the period, we can expect that including the distributions would result in investors in the Franklin Limited Duration Income Trust doing far better than investors in the two indices. That is indeed the case:

As we can see, investors in the Franklin Limited Duration Income Trust have realized a 6.87% total return since we last discussed the fund in January. This is nowhere near as good as some other funds managed to deliver over the same period, but it is still respectable and results in a pretty solid annualized total return. The fund has also substantially outperformed its peers over the period:

Thus, this fund certainly seems to have been a very solid pick over the past several months for investors who are looking to earn a very high level of current income without exposing themselves to an excessive amount of interest rate risk. I put a “buy” rating on the fund back in January and so far, it seems like it has deserved the rating.

Naturally, though, five months have passed since we last discussed the fund, so naturally many things have changed. In particular, the fund has released a more recent financial report that shows how it did during the second half of 2023. We will want to pay special attention to this report over the remainder of this article, as it will provide a great deal of useful information.

About The Fund

According to the fund’s website, the Franklin Limited Duration Income Trust has the primary objective of providing its investors with a very high level of current income. Unfortunately, the fund’s website provides very limited information about how the fund will achieve this goal. The strategy statement is sparse:

In addition to this statement that tells us basically nothing about the assets that the fund is investing in, the website includes the following statement about the fund:

The fund seeks to provide high, current income, with a secondary objective of capital appreciation by investing primarily in high yield corporate bonds, floating rate corporate loans and mortgage- and other asset-backed securities.

This tells us simply that the portfolio will include a combination of junk bonds, leveraged loans, and asset-backed securities. Neither this statement nor the one screenshotted above provides any information about the percentage of the fund’s assets that will be invested in any given security type. In fact, the statements do not specify whether the fund is investing solely in domestic securities or if international securities might also be included. It is important for investors to know these things because of the impact that they can have on the fund’s financial and market performance. For example, consider the following:

- Foreign bonds have outperformed domestic bonds year-to-date due to a combination of interest rate cuts in some developed countries and a decline in the market’s perceptions of the U.S. dollar as a store of value.

- Floating-rate loans do not decline in price when interest rates move, while bond prices do.

- Commercial mortgage-backed securities are a troubled sector right now, partly due to high vacancy rates in several cities across the United States.

Obviously, the fund’s allocation to each of these different types of security can have an impact on its performance because each of these securities can deliver different performances depending on the conditions in the market. It is, however, not astounding that the website provides limited information about the fund’s strategy, as that has been a common complaint of mine about Franklin Templeton-sponsored funds.

The fund’s annual report provides a bit more information about the fund’s strategy, but admittedly, it still does not go as in-depth as we would like. Here is what this document states:

The Fund seeks to provide high, current income, with a secondary objective of capital appreciation to the extent possible and consistent with the Fund’s primary objective, through a portfolio consisting primarily of high-yield corporate bonds, floating rate corporate loans and mortgage- and other asset-backed securities. We invest in a diversified mix of fixed income securities, primarily high-yield corporate bonds, senior secured floating rate corporate loans, and mortgage- and other asset-backed securities. The Fund may also invest a portion in marketplace loans. Our top-down analysis of macroeconomic trends combined with a bottom-up analysis of market sectors, industries and issuers drives our investment process. We seek to maintain a limited duration, or interest-rate sensitivity, to moderate the impact that fluctuating interest rates might have on the Fund’s fixed income portfolio. Within the corporate bond and corporate loan sectors, we seek securities trading at reasonable valuations from issuers with characteristics such as strong market positions, stable cash flows, reasonable capital structures, supportive asset values, strong sponsorship and improving credit fundamentals. In the mortgage- and other asset-backed securities sector, we look to capture an attractive income stream and total return through our analysis of security prepayment assumptions, potential pricing inefficiencies and underlying collateral characteristics.

The most important thing that this adds to the website’s statements is that the fund will try to be invested in all the different asset classes (junk bonds, leveraged loans, mortgage-backed securities, and asset-backed securities) at any given time. The above description does not explicitly forbid the fund from investing in preferred or even common equities, however.

The fund’s annual report states that it had the following asset allocation on December 31, 2023:

|

Asset Type |

% of Net Investments |

|

Common Stocks |

0.6% |

|

Preferred Stocks |

0.0% |

|

Warrants |

0.0% |

|

Corporate Bonds |

46.9% |

|

Senior Floating Rate Loan Interests |

42.3% |

|

Marketplace Loans |

21.1% |

|

Asset-Backed Securities |

14.2% |

|

Commercial Mortgage-Backed Securities |

1.0% |

|

Mortgage-Backed Securities |

15.4% |

|

Money Market Funds |

3.4% |

The fund’s first-quarter 2024 holdings report provides a somewhat different asset allocation as of March 31, 2024:

|

Asset Type |

% of Net Investments |

|

Common Stocks |

0.6% |

|

Preferred Stocks |

0.0% |

|

Warrants |

0.0% |

|

Corporate Bonds |

49.0% |

|

Senior Floating Rate Loan Interests |

41.9% |

|

Marketplace Loans |

21.0% |

|

Asset-Backed Securities |

14.4% |

|

Commercial Mortgage-Backed Securities |

1.0% |

|

Mortgage-Backed Securities |

15.1% |

|

Escows and Litigation Trusts |

0.0% |

|

Money Market Funds |

2.7% |

One thing that we immediately notice is that during the first quarter of 2024, the Franklin Limited Duration Income Trust increased its weighting to corporate bonds at the expense of floating-rate loans and money market funds. The remaining assets held by this fund experienced relatively limited weighting changes, although the fund’s allocation to residential mortgage-backed securities did decline a bit.

The increase in the fund’s corporate bond holdings relative to senior floating-rate loans was not caused by one asset class outperforming another in the market. As we can see here, the iShares Floating Rate Bond ETF (FLOT) outperformed both investment-grade and junk bonds during the first quarter of 2024:

Thus, if the fund had simply used a buy-and-hold strategy, its senior floating rate loan interests would have increased relative to the corporate bond position in the first quarter. The fact that the opposite occurred means that the fund actually sold some of its senior loans and used the money to purchase corporate bonds during the first quarter of 2024 (the fund also used some cash, as is evidenced by the reduction in cash equivalents).

I am not certain that this change was a good idea. As we discussed in various articles from late last year, the market was expecting that the Federal Reserve would cut the federal funds rate by 150 basis points over the course of 2024. Economic data was far too strong to ever justify such a move by the nation’s central bank, though, and the market began to realize this in early January. That is the event that caused bond prices to begin declining and bond yields to rise at that time. This has continued until the present day. However, the fund’s move suggests that management is trying to profit from rising bond prices, which have generally not been seen. The Federal Reserve’s comments following the Federal Open Market Committee earlier this month strongly suggest that interest rates will remain high for a lot longer than the market expected even back in May.

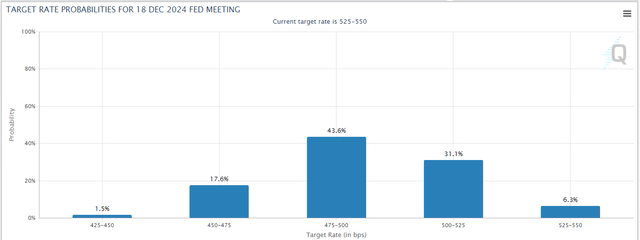

According to the Chicago Mercantile Exchange’s FedWatch tool, the market is currently expecting two 25-basis point cuts to the federal funds rate by the end of 2024:

We can see that the highest probabilities are assigned to one or two 25-basis point cuts by year-end. However, the highest probability is assigned to the 475 to 500 basis point federal funds target range. Achieving this would require two interest rate cuts by the end of the year. The Federal Open Market Committee has four meetings remaining this year:

- July 31,

- September 18,

- November 7,

- December 18.

It is unlikely that any data will be released over the next month that will prompt the Federal Open Market Committee to reverse the hawkish pivot that it undertook earlier this month. Thus, we can probably state with confidence that there will not be a rate cut at the July meeting. That leaves three meetings over the remainder of 2024. The September meeting is almost certainly too close to the presidential election for any change to monetary policy. The election is on November 5, so it is conceivably possible that there will be rate cuts in both November and December. That would almost certainly require that the economy be in a recession when the voters go to the polls though, and the Federal government will almost certainly use fiscal stimulus as much as possible to prevent that scenario.

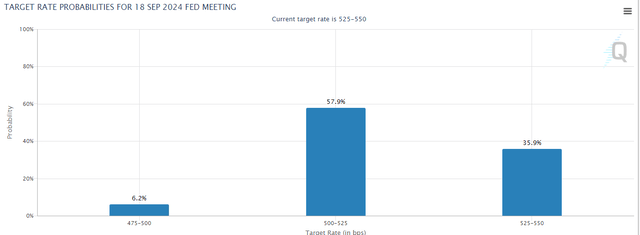

For its part, the market is strongly predicting a cut at the September meeting:

The Federal Reserve itself stated earlier this month that this scenario is unlikely. The Federal Open Market Committee said that only a single rate cut is being considered for this year. As I stated in a previous article, that is almost certainly going to be in December.

Thus, there is still a strong possibility that fixed-rate bonds are overpriced despite their recent weakness. As such, leveraged loans appear likely to outperform corporate bonds over the remainder of this year. This obviously means that the fund’s decision to reduce its leveraged loan exposure in favor of corporate bonds during the first quarter was probably not the right decision.

With that said, it is certainly possible that the fund has pivoted its portfolio back towards floating-rate securities as it has become more obvious that the market’s aggressive expectations of interest rate cuts were too optimistic. The fund had a 104.86% turnover rate last year, so it is certainly doing a lot of trading and making frequent changes to its portfolio. This certainly seems high for a bond fund, but it is not substantially higher than all the fund’s peers:

|

Fund Name |

Portfolio Turnover |

|

Franklin Limited Duration Income Trust |

104.86% |

|

Allspring Multi-Sector Income Fund |

42.00% |

|

BlackRock Limited Duration Income Trust |

106.00% |

|

Eaton Vance Limited Duration Income Fund |

199.00% |

|

PCM Fund |

20.00% |

(All figures from the most recently filed annual reports for each respective fund.)

A 104.86% turnover means that the fund is very actively changing its portfolio. To a certain extent, this makes sense. Low-duration securities either have near-term maturities or very high coupon rates. Basically, duration is the amount of time that it takes all the payments that the security makes to its holders to total the face value of the asset. This could mean that at least some of this high turnover is driven by bonds maturing and the money needing to be reinvested.

A look over the fund’s schedule of investments reveals that many of the corporate bonds mature in the 2025 to 2030 period. The fund’s website states that the average time to maturity of the securities in the portfolio was 8.08 years on May 31, 2024, so it seems unlikely that all the turnover is driven by the maturation of the securities held by the fund. Rather, the fund is trading securities on an active basis for some reason. This means that the exact composition of this fund will change on a fairly regular basis. While this will result in the fund having higher expenses compared to a fund that engages in much lower trading activity, this seems to be an integral part of the investment process given that the fund’s peers have similarly high turnover rates. Thus, we probably should not be too concerned about it.

Leverage

As is the case with most closed-end funds, the Franklin Limited Duration Income Trust employs leverage as a method of boosting the effective yield and total return that it earns from the assets in its portfolio. I explained how this works in my previous article on this fund:

In short, the fund borrows money and uses that borrowed money to purchase junk bonds, leveraged loans, and other income-producing securities. As long as the purchased securities have higher yields than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case.

However, it is important to note that the use of leverage is less effective at boosting the effective yield of a portfolio than it was a few years ago. This is because borrowing rates today are much higher than they were a few years ago when the federal funds rate was close to zero. The strategy should still theoretically work though since the yield of most junk bonds and leveraged loans should be higher than the rate at which the fund can borrow money.

The use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. This is almost certainly one reason why the fund’s shares have been more volatile than we might expect considering the assets that are in the portfolio. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally do not like a fund’s leverage to exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Franklin Limited Duration Income Trust has leveraged assets comprising 32.01% of its portfolio. This represents a considerable increase over the 27.88% leverage ratio that the fund had the last time that we discussed it.

It is not surprising that the fund’s leverage ratio increased over the past five months. As we can see here, the fund’s net asset value decreased over the period:

As we can see, the fund’s net asset value declined by 0.98% since the last time that we discussed the fund. This is in direct contrast to the share price increase that the fund experienced over the same period. That will almost certainly have an impact on the fund’s valuation since it implies that the fund is more expensive today than it was a few years ago. We will discuss that later in this article. For now, though, the fact that the fund’s net asset value decreased is directly responsible for the increase in the leverage ratio. After all, the fund’s outstanding borrowings now represent a larger proportion of a smaller portfolio than they did back in January. However, the increase in leverage seems considerable considering that the fund’s net asset value only declined by 0.98%. This could mean that the fund borrowed more money during the interim period.

The fund’s leverage ratio still remains below the one-third of assets maximum level that we would ordinarily prefer, however. This suggests that the fund is still running a reasonable balance between the risks and the potential rewards of the use of leverage. However, we should compare its leverage ratio to that of other funds utilizing a similar strategy:

|

Fund Name |

Leverage Ratio |

|

Franklin Limited Duration Income Trust |

32.01% |

|

Allspring Multi-Sector Income Fund |

29.60% |

|

BlackRock Limited Duration Income Trust |

37.20% |

|

Eaton Vance Limited Duration Income Fund |

38.30% |

|

PCM Fund |

41.06% |

(all figures from CEF Data.)

As we can clearly see, the leverage ratio of the Franklin Limited Duration Income Trust is below the median level employed by similar funds using a low-duration strategy. This adds to our confidence that this fund is not employing too much leverage. Overall, everything should be okay when it comes to the fund’s leverage.

Distribution Analysis

The primary objective of the Franklin Limited Duration Income Trust is to provide its shareholders with a very high level of current income. In accordance with this objective, the fund pays a monthly distribution of $0.0615 per share ($0.7380 per share annually). This gives the fund an 11.59% yield at the current price. As we saw in the introduction, this yield generally compares pretty well to the fund’s peers.

Unfortunately, the Franklin Limited Duration Income Trust has not been especially consistent with its distribution over the years:

As I stated previously:

This is something that might prove to be a turn-off for any investor who is seeking to earn a safe and consistent income from the assets in their portfolios. After all, many investors who purchase a fund like this are looking to get a regular distribution that they can use to pay their bills or finance their expenses. It is very difficult to budget when their income varies from month to month. However, it is not exactly a bad thing from the fund’s perspective since the variable distributions helps to ensure that it only pays out its investment profits and does not destroy net asset value. As everyone reading this likely knows, it is nearly impossible to earn exactly the same amount of money in the capital markets every month.

As mentioned in the introduction, the fund recently released its annual report (linked earlier) which should give us a better idea of how well the fund is covering its distributions than we had previously. After all, this report will include information about its performance during the second half of last year, which we did not have available the last time that we discussed it.

For the full-year period that ended on December 31, 2023, the Franklin Limited Duration Income Trust received $625,790 in dividends and $37,237,188 in interest from the assets in its portfolio. This gives the fund a total investment income of $37,862,978 for the full-year period. The fund paid its expenses out of this amount, which left it with $26,242,599 available for shareholders. That was insufficient to cover the $28,667,613 that the fund paid out to its investors during the period.

Fortunately, the fund was able to make up the difference through capital gains. For the full-year period, the Franklin Limited Duration Income Trust reported net realized losses of $20,405,837, but these were fully offset by $27,710,021 net unrealized gains. Overall, the fund’s assets increased by $4,879,170 after accounting for all inflows and outflows during the period.

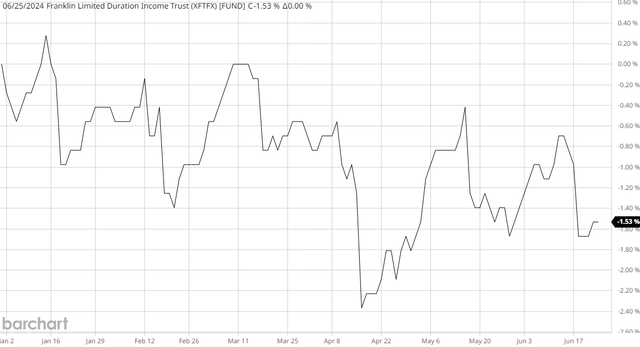

Thus, the Franklin Limited Duration Income Trust managed to cover its distributions fully during the full-year period, but it was only able to do so because of unrealized gains. This could be concerning because of the possibility that unrealized gains can be erased by a market correction. This was the case with this fund year-to-date:

This fund shows the fund’s net asset value since the closing date of its most recent financial report. As we can see, the fund’s net asset value has declined by 1.53% since that date. This could mean that some of the net unrealized gains that the fund earned last year have been erased, or that it has paid out considerably more than it has managed to earn from its portfolio since the beginning of this year. In either case, this casts doubt on the fund’s ability to sustain its distribution despite its strong performance last year.

Valuation

Shares of the Franklin Limited Duration Income Trust are currently trading at a 10.47% discount to net asset value at the current price. This is a considerable discount, although it is in line with the 10.88% discount that the shares have had on average over the past month. As such, the current price looks quite reasonable for anyone who wishes to add this fund to their portfolio.

Conclusion

In conclusion, the Franklin Limited Duration Fund is an interesting alternative to typical bond funds for investors who want to earn a solid level of income without taking on too much interest rate risk. However, the fund has been losing money this year and failing to cover its distribution. This is quite disappointing given the fund’s significant distribution increase back in January. There are also some reasons to believe that bonds in general might be overpriced, despite the decline in prices that we have already seen year-to-date. As such, there does not appear to be a reason to rush into bond funds like this one.

Due to the fund’s strong year-to-date performance despite the net asset value decline and its failure to cover its distributions, a rating downgrade seems appropriate here.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.