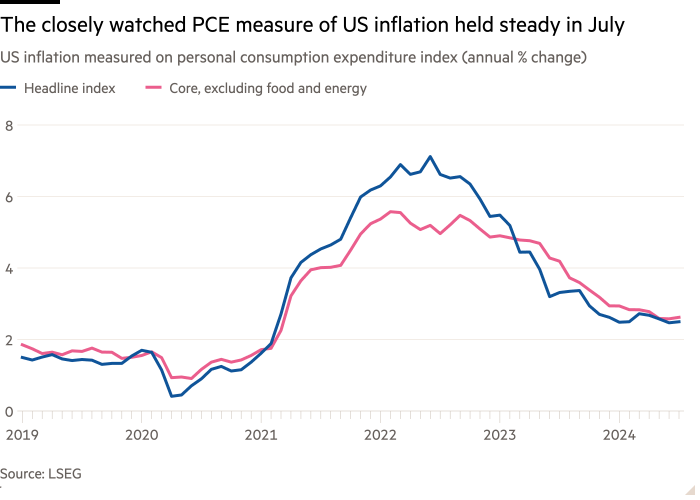

The Federal Reserve’s preferred measure of inflation held steady at 2.5 per cent in the year to July, according to data released on Friday that paves the way for the US central bank to start cutting interest rates next month.

The personal consumption expenditures price index compared with economists’ expectations of a 2.6 per cent rise and June’s figure of 2.5 per cent. The Fed’s target for the headline PCE index is 2 per cent a year.

“Core” PCE — which strips out volatile food and energy costs — remained at 2.6 per cent, below the forecast 2.7 per cent.

The figures from the commerce department come after Fed chair Jay Powell said last week that the “time has come” to begin cutting rates as inflation eases and the labour market slows.

Powell’s comments at the annual Jackson Hole conference made it all but certain that the central bank will lower its main rate from its current range of between 5.25 and 5.5 per cent at its next meeting in September.

Much of the debate among Fed watchers has now shifted to whether the central bank will cut by 0.25 or 0.5 percentage points, and how steep the reductions will be for the rest of the year.

US government bond prices eased slightly following the publication of the data. The yield on the two-year Treasury note, which rises when prices fall, was up 0.02 percentage points on the day, at 3.92 per cent.

The S&P 500 was up 0.6 per cent in mid-morning trading on Wall Street.

Gregory Daco, chief economist at EY, said that the report “does not indicate that inflation is moving up in any way”, adding that it “highlights as expected that the Fed has the option” to begin lowering rates.

The data will come as a boost to the Biden administration and vice-president Kamala Harris’s presidential campaign, since it provides further evidence that inflation is easing.

It will also help to blunt attacks by Republican rival Donald Trump on Harris over the cost of living, which remains a key concern for voters.

On Thursday, during her first big interview since she entered the race, Harris told CNN she was “very proud of the work that we have done that has brought inflation down to less than 3 per cent”.

But she added that there was “more to do” to bring down expenses for middle- and working-class households.

The bigger economic concern for Harris is now the slowing labour market, and whether it will affect voter sentiment heading into November’s election.

Next week’s release of jobs and unemployment figures for August could be pivotal, after the July data showed an unexpected slump.

“Payrolls takes on even more importance because what [the Fed] really needs to look at is the speed of the deterioration and whether they can arrest that,” MetLife Investment Management chief market strategist Drew Matus said. “The soft landing is a lot harder to achieve than people think, in part because it really requires a lot of foresight and willingness to act far in advance of evidence, and that’s not something this Fed has been willing to do in the past.”

However, the commerce department data on Friday showed no signs of a downward shift in consumer spending. Personal consumption expenditures rose by 0.5 per cent in July compared with a 0.3 per cent increase in June.

Personal income rose 0.3 per cent compared with 0.2 per cent the previous month.